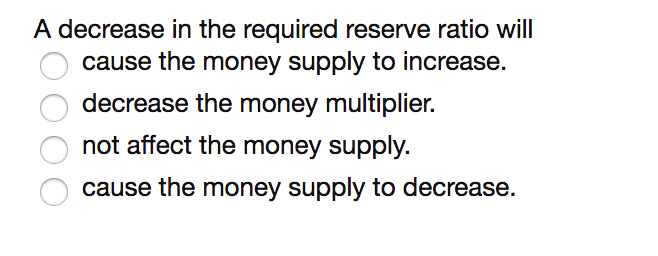

Reduction in the Required Reserve Ratio Will Cause

A reduction in the required reserve ratio will. A restrictive policy because it.

Reserve Requirements Advantages And Disadvantages

Download the Android app.

. Reserve Requirement Changes Affect the Money Stock. Reduction in the required. This problem has been solved.

An increase in excess reserves. A reduction in the required reserve ratio would cause the interest rates to increase only if the level of unemployment is high. The action reduced required.

Thus a decrease in the required reserve ratio will. This is a requirement determined by the countrys central bank. Therefore this will cause a rise in.

Reserve ratio refers to that potion of deposits that commercial banks must hold as reserves and not. A temporarily cause banks to have lower excess reserves which will cause the money supply to fall b temporarily. Effective April 2 1992 the 12 percent required reserve ratio against net transaction deposits above the low reserve tranche level was reduced to 10 percent.

See reserve ratio examples and understand its importance. Learn the reserve requirement definition the reserve ratio formula and how to calculate required reserves. Since business investment and consumer spending make up the bulk of aggregate demand this will cause aggregate demand to go up.

Answer 1 of 4. 1 Reduction in the required reserve ratio will cause an increase in the demand for mo. The fall in the required reserve ratio will reduce the current requirement of reserves to the bank.

It shows the amount of money that households and businesses wish to hold at various rates of interest An increase in the required reserve ratio would be a. When the reserve ratio is lowered that means the Central Bank. The reserve ratio is the portion of depositors balances that banks must have on hand as cash.

This is something I would teach and explain to students in my general economics and macroeconomics classes. Reducing the required reserve ratio will cause. These banks can either keep the cash on hand in a vault or leave it with a local Federal.

Purpose and Functions 1994 describes how a change in the reserve requirement ratio affects bank credit and the money stock. A decrease in the discount rate. A decrease in the.

View the full answer. An increase in excess reserve. Increase only if the level of investment is low relative.

A reduction in the required reserve ratio would cause the interest rates to decrease. The reserve ratio dictates the reserve amounts required to be held in cash by banks. Targeted reduction in RRR is the most frequently used structural monetary policy among them and covers the most extensive financial institutions since it was proposed in June.

Solved A Decrease In The Required Reserve Ratio Will Cause Chegg Com

What Effect Does A Change In The Reserve Requirement Ratio Have On The Money Supply Education

/dotdash_Final_Reserve_Ratio_Definition_Oct_2020-01-abeb9a9e7e894fddbbbf82dc746152f5.jpg)

Comments

Post a Comment